If you have a 100k investment and are looking for an option that provides a passive income and predictable returns, consider real estate investment. You can build huge equity quickly and with minimal work by investing in real estate. With a 100k down payment, you can buy a million dollars house and grow huge equity over time.

Real estate is the best way to invest.

Real estate is the best way to invest a large sum of money. Not only does real estate earn a substantial cash flow each year, but it can also provide a solid personal asset for future generations. If you're looking to diversify your portfolio, investing in real estate can be a good option.

Passive investments are possible with IRAs

An IRA could be a good investment option for 100k, as well as offering tax benefits. It also gives you more freedom in your investments than a 401(k) plan, with the ability to invest in stocks, ETFs, and alternative asset classes. With the right investment strategy, you can grow your investment over the long term, while taking advantage of tax advantages.

Mutual funds

Make sure you carefully choose which funds to invest $100k. Stock investing can be very risky, especially if it's not done properly. Bonds on the other side are less risky. However, you'll earn lower returns with them. Your age and general health are important factors to consider. Be sure to consider whether you are able to afford to leave your money alone for five years or more.

ETFs

You should switch to mutual funds or exchange-traded funds if you are looking to invest 100 thousand dollars. These passive investments come with low fees and can automatically be set up to invest recurring amounts. ETFs outperform individual stocks and are therefore a very popular choice for investors.

DIY SIPPs

You should be aware of the following factors before you consider a DIY SIPP to make your first 100k. First, you'll need to choose an investment platform. Also, decide how much money you are willing to invest. You can check out their SIPP if you want to invest in Vanguard funds. If that is not possible, you may want to investigate other SIPP providers like Hargreaves Lansdown oder Fidelity.

Tax benefits of investing in a 401(k)

There are many tax incentives to investing in your 401(k). First, it is tax-deferred. This means that your money grows tax-deferred up until the time you retire. This tax-deferral advantage is available to both Roth and traditional 401(k).

FAQ

How do I eliminate termites and other pests?

Your home will eventually be destroyed by termites or other pests. They can cause severe damage to wooden structures, such as decks and furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

Do I need flood insurance?

Flood Insurance protects you from flooding damage. Flood insurance protects your possessions and your mortgage payments. Learn more about flood insurance here.

How much should I save before I buy a home?

It all depends on how many years you plan to remain there. Save now if the goal is to stay for at most five years. However, if you're planning on moving within two years, you don’t need to worry.

Do I need to rent or buy a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting lets you save on maintenance fees as well as other monthly fees. However, purchasing a condo grants you ownership rights to the unit. The space can be used as you wish.

Can I get a second loan?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

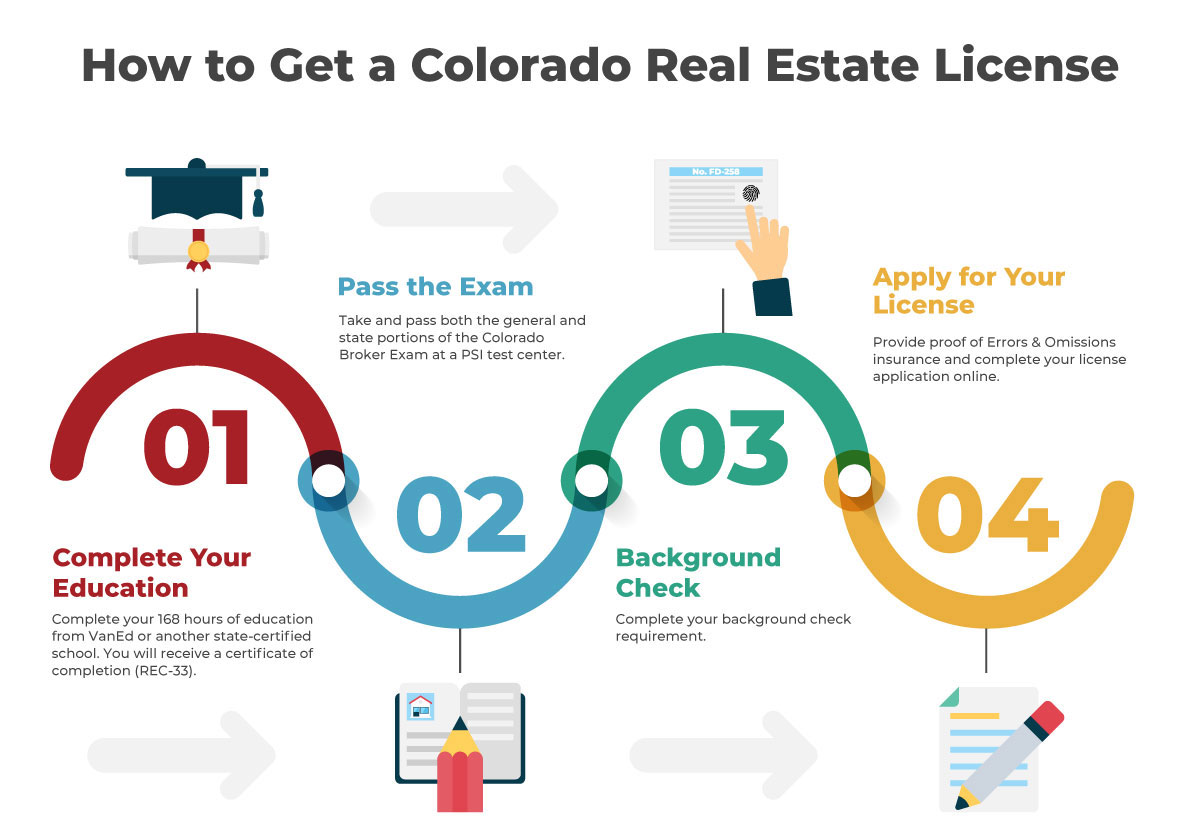

How to become real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This means that you will need to study at least 2 hours per week for 3 months.

This is the last step before you can take your final exam. To become a realty agent, you must score at minimum 80%.

These exams are passed and you can now work as an agent in real estate.