You can calculate rental income whether you are a novice or a professional. It will also allow you to decide whether a rental property is suitable for your investment and financial goals.

Calculate ROI on Real Estate

To calculate an investment's return on equity, investors should know the specifics of the property they are investing in and what kind of returns they can expect. This information includes the property's price, its closing costs, any required repairs and remodeling. Investors also need to know the rent generated by the property and how many tenants will be living there.

The purchase cost is a major factor in calculating your return on investment for a rental. This includes any money you spend on the property or costs related to it, like inspections and title insurance.

In determining the return on an investment, mortgage expenses should also be considered. These expenses can include monthly payments, interest rates and any fees that come with the loan.

This is another way of estimating a property's return on investment. This includes the cash flow produced by a home after expenses, but before mortgage payments.

The Cap Rate should also be considered when calculating the ROI of a property. The cap rate is the value of a property based on current market conditions. This calculation can be a little more complicated, but it's still very useful.

Appreciation increases the value of your property and allows you to make extra money. A property's worth will typically increase by between 3.5% and 3.8 % per year.

Other sources of income such as utility bills and rental income can also impact a property's return on investment. When estimating a property’s ROI, these sources of income can be overlooked. However, they are important in creating a profitable portfolio.

The 2% Rule in Real Estate is a simple method for calculating a property’s ROI. The 2% rule says that a home should generate a monthly cash flow of at least 2 percent of the purchase price.

By using this formula, it is possible to see that an investment property that sold for $200,000 would produce $10,500 of annual returns. Then, we can multiply this by the property's $1,500 in closing costs and $10,000 in remodeling to get the total ROI on the property.

The percentage of a good return on investment varies from investor to investor. However, most investors aim for at least 10%. You as an investor can decide on your own what you consider a high ROI, but knowing the different methods to calculate it before making a final decision is useful.

Smart investors can use multiple calculations to calculate a property's return on investment and compare these numbers with their income expectations. This is especially helpful when deciding whether or not a particular investment is a wise choice for their personal financial goals.

FAQ

What amount should I save to buy a house?

It depends on how much time you intend to stay there. It is important to start saving as soon as you can if you intend to stay there for more than five years. But if you are planning to move after just two years, then you don't have to worry too much about it.

What is a reverse loan?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. You can draw money from your home equity, while you live in the property. There are two types: government-insured and conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance will cover the repayment.

What should you consider when investing in real estate?

First, ensure that you have enough cash to invest in real property. If you don’t have the money to invest in real estate, you can borrow money from a bank. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

It is also important to know how much money you can afford each month for an investment property. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Finally, you must ensure that the area where you want to buy an investment property is safe. It would be best if you lived elsewhere while looking at properties.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to become a broker of real estate

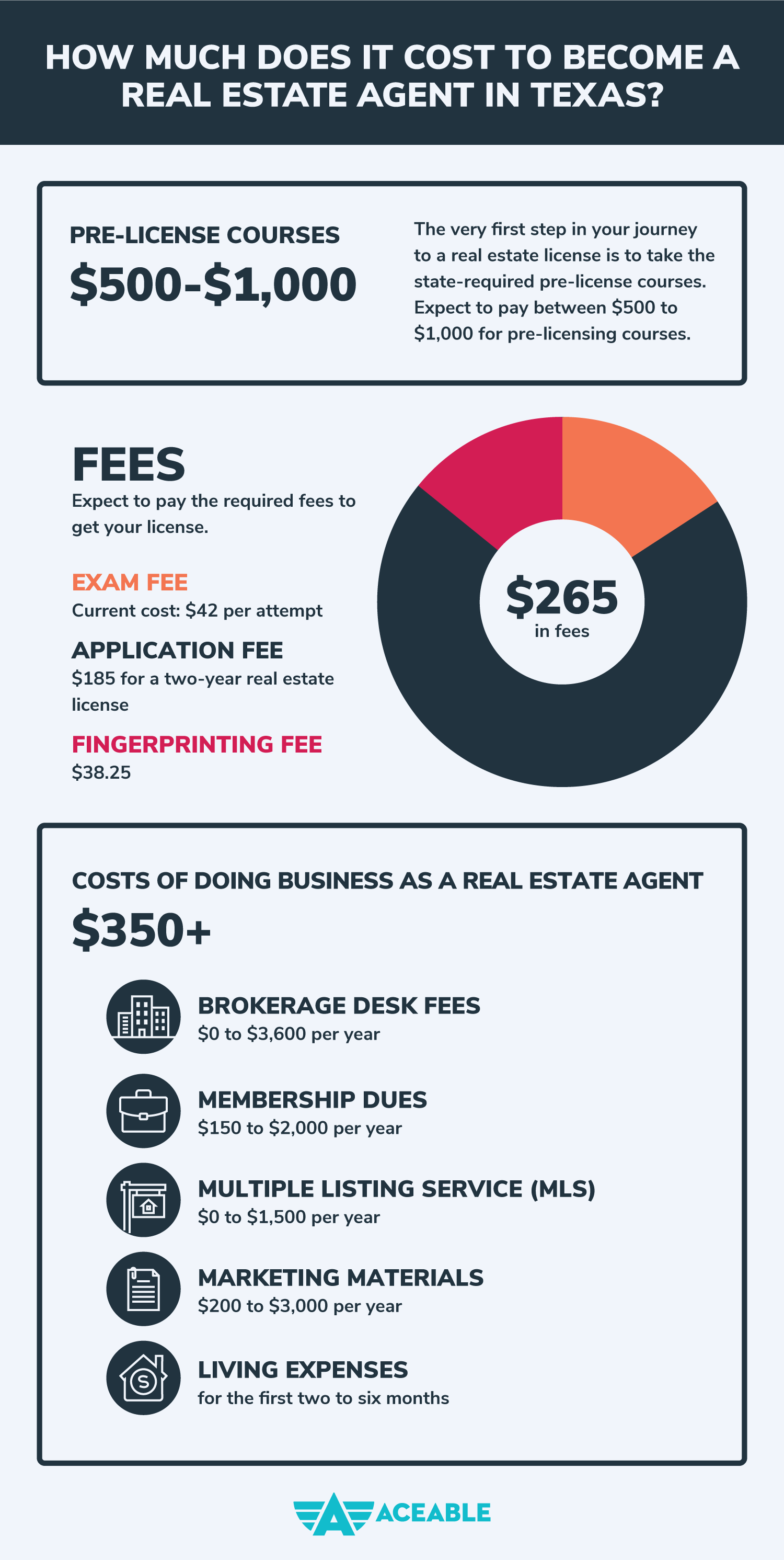

You must first take an introductory course to become a licensed real estate agent.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This involves studying for at least 2 hours per day over a period of 3 months.

Once this is complete, you are ready to take the final exam. You must score at least 80% in order to qualify as a real estate agent.

These exams are passed and you can now work as an agent in real estate.