A contingent offer is an agreement between a buyer and seller that stipulates that certain conditions must be met before the sale can proceed. The conditions could include a home inspection, appraisal, or mortgage. A lawyer or agent can help the buyer design and implement their offer, including any contingencies.

House Sale Contingency

The most common type is a home inspection condition. Buyers use this to protect their investment from being unable to fix any problems found during the home inspection. If there are issues discovered during the home inspection that cannot be repaired, buyers have the option to cancel the contract and get their earnest money deposit back.

Another type of house sale contingency that is common is the appraisal contingency. This contingency protects buyers with a mortgage who don't want to lose their earnest cash if the appraise comes in lower than the home's actual price.

This contingency can be used by buyers who wish to prevent fraud from being made on their purchase or sale. By adding a clause that requires the seller to remove any liens from the property, this can be done before the sale can close.

Home Sale Contingency

This is a dangerous sale contingency. A seller must be prepared to accept an offering on a property. Depending on the buyer's timeline to sell their current house, it may or may not go through. It is a very high risk offer that sellers are not willing to accept.

Sellers who accept a contingent deal will still have to make improvements and cosmetic changes to their house, then list it, show it to buyers and evaluate offers. If the buyer declines to be approved for a mortgage, or their offer falls short, the seller will need to accept a backup offer from a potential buyer while they wait for the house's closing.

A contingent listing, which allows sellers to attract large numbers of potential buyers during a house sale market, can be a great way to sell their home while it is being listed. This is especially beneficial for homes that are currently on the market longer than usual or in a downturn.

In a seller's marketplace, there are more homes available for sale than buyers qualified. Contingent sales tend to be less common. These markets are more likely to see the original buyer leave their deal before it can close.

A contingent sale can offer buyers the opportunity to purchase their dream home while protecting their earnest deposit. However, it's important to remember that a contingency is only as strong as the buyer's confidence in their offer. You should carefully consider the possibility that you might lose your earnest cash deposit before you submit an offer for any property.

FAQ

How can I repair my roof?

Roofs can become leaky due to wear and tear, weather conditions, or improper maintenance. Repairs and replacements of minor nature can be made by roofing contractors. Contact us for further information.

How many times may I refinance my home mortgage?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. In either case, you can usually refinance once every five years.

What are the pros and cons of a fixed-rate loan?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

How much does it cost to replace windows?

Windows replacement can be as expensive as $1,500-$3,000 each. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

What should you look out for when investing in real-estate?

It is important to ensure that you have enough money in order to invest your money in real estate. If you don’t have the money to invest in real estate, you can borrow money from a bank. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

You should also know how much you are allowed to spend each month on investment properties. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

Also, make sure that you have a safe area to invest in property. It would be a good idea to live somewhere else while looking for properties.

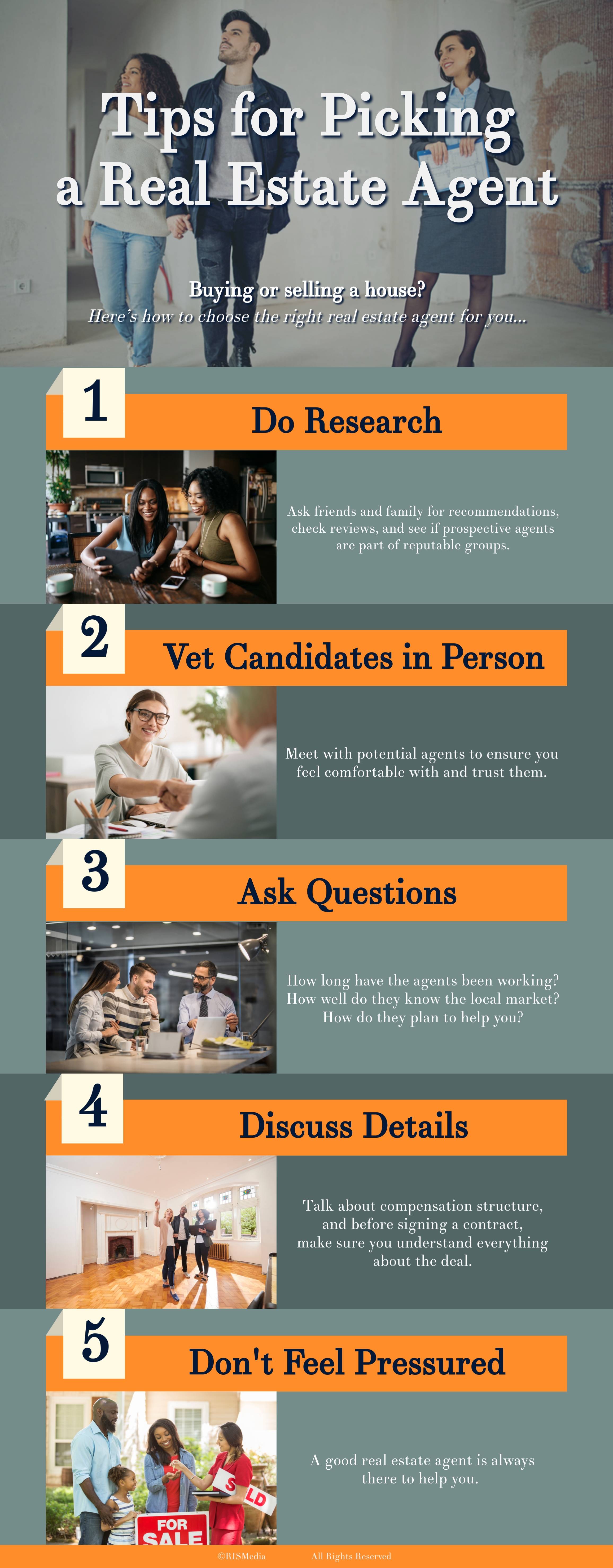

What should I be looking for in a mortgage agent?

A mortgage broker helps people who don't qualify for traditional mortgages. They compare deals from different lenders in order to find the best deal for their clients. There are some brokers that charge a fee to provide this service. Some brokers offer services for free.

How long will it take to sell my house

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It can take anywhere from 7 to 90 days, depending on the factors.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to become an agent in real estate

Attending an introductory course is the first step to becoming a real-estate agent.

Next you must pass a qualifying exam to test your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

After passing the exam, you can take the final one. To become a realty agent, you must score at minimum 80%.

All these exams must be passed before you can become a licensed real estate agent.