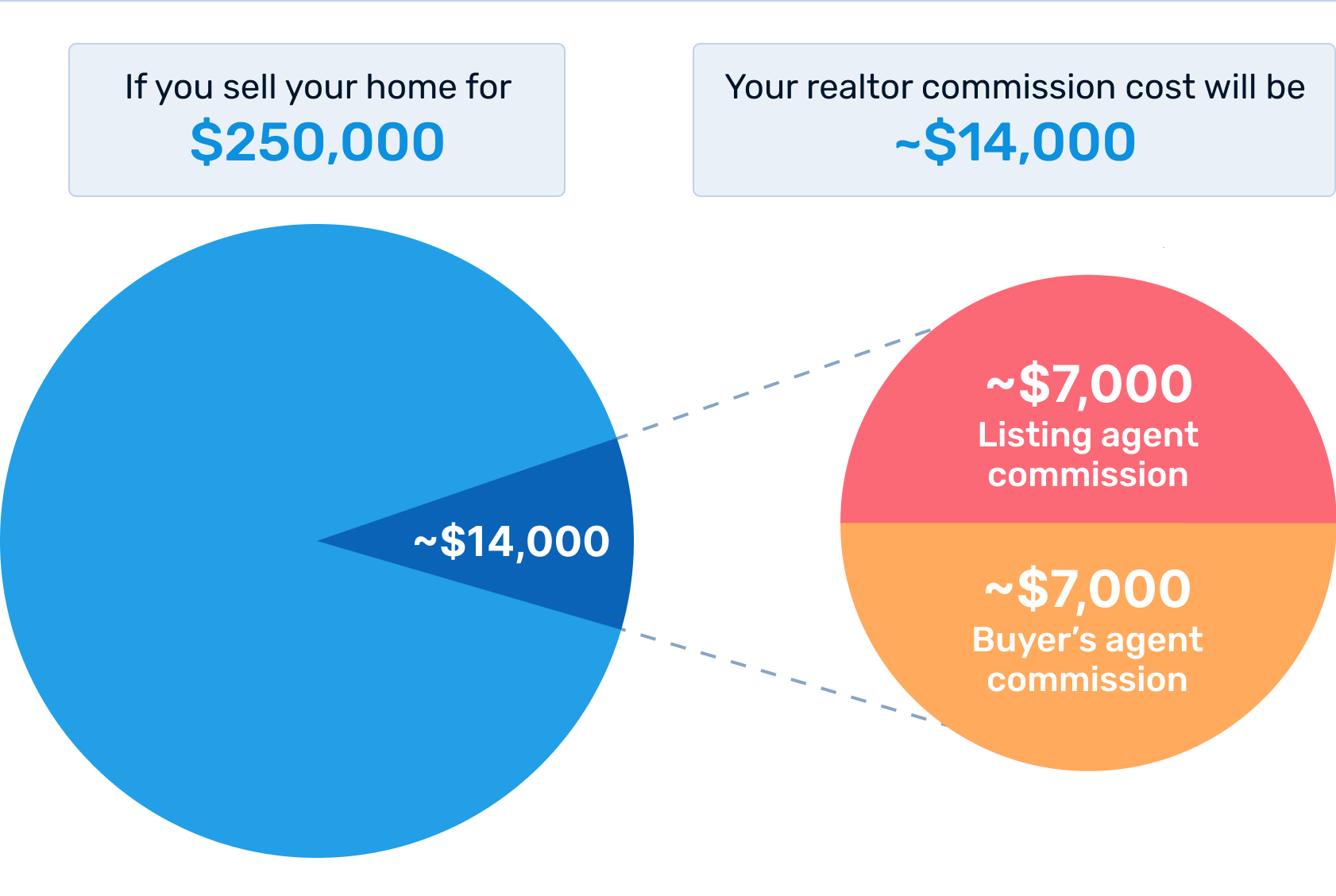

Michigan real estate agents will charge a commission if you are selling your house. The amount you pay will vary depending on what type of property you are selling. You can get a lower rate if you're able to negotiate with your agent. It is a good idea to work with a low-commission broker.

When a property is sold, a realtor receives a commission of 5% to 6.6%. The commission is split between seller and buyer. It's important to understand how the percentage will vary by city and price. The average real estate commission is higher for homes that are more expensive than others.

If you're looking to sell your home in Michigan, the first step is to consult with a realtor. You can get an estimate of the cost of your home on the open market from a realtor. Many factors can affect the price of a home. However, the largest factor that influences the price of a property is the proportion of the closing cost that goes to the commission. Saving thousands of dollars by looking for a realtor with a reduced commission can help you save thousands.

Michigan's average realty commission is 6%. In fact, it's higher than the national average of 5.37%. Depending on the local housing market, you may be able to negotiate a less expensive fee. A lower commission may also depend on how experienced your agent is. Although more experienced agents may be less likely to negotiate, there are still options.

Some sellers prefer to work in a brokerage that offers a low commission model. Houzeo, a popular online platform for selling homes in Michigan, is an example. Home buyers have the ability to view all available properties online, submit an offer and negotiate directly with an agent. The 100% virtual service of the company helps you avoid high commissions.

Another option is to work with a brokerage that offers 1% listing fees. This is often up to 27% less than the average rate. Clever Real Estate is an example of such a company. They'll match you with top agents. They'll help you negotiate your listing fee and get your home sold.

In the US, the majority of home transactions involve a real estate agent. Agents aid buyers and sellers with property descriptions and ordering photographs. They also show the property. Many homeowners are willing to pay for these services. As the country's property market recovers, homeowners are willing to pay more for these services.

Many real estate brokers offer a variety benefits packages. These benefits can include a salary package for agents, insurance coverage, or other financial support. Both buyers and sellers will benefit from choosing a broker.

The real estate commission in Michigan is typically a little higher than the national average. If you want to maximize your profits, you can negotiate a lower rate. But, before you do, make sure you research your agent.

FAQ

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

How much money will I get for my home?

The number of days your home has been on market and its condition can have an impact on how much it sells. The average selling price for a home in the US is $203,000, according to Zillow.com. This

What is the maximum number of times I can refinance my mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. Refinances are usually allowed once every five years in both cases.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

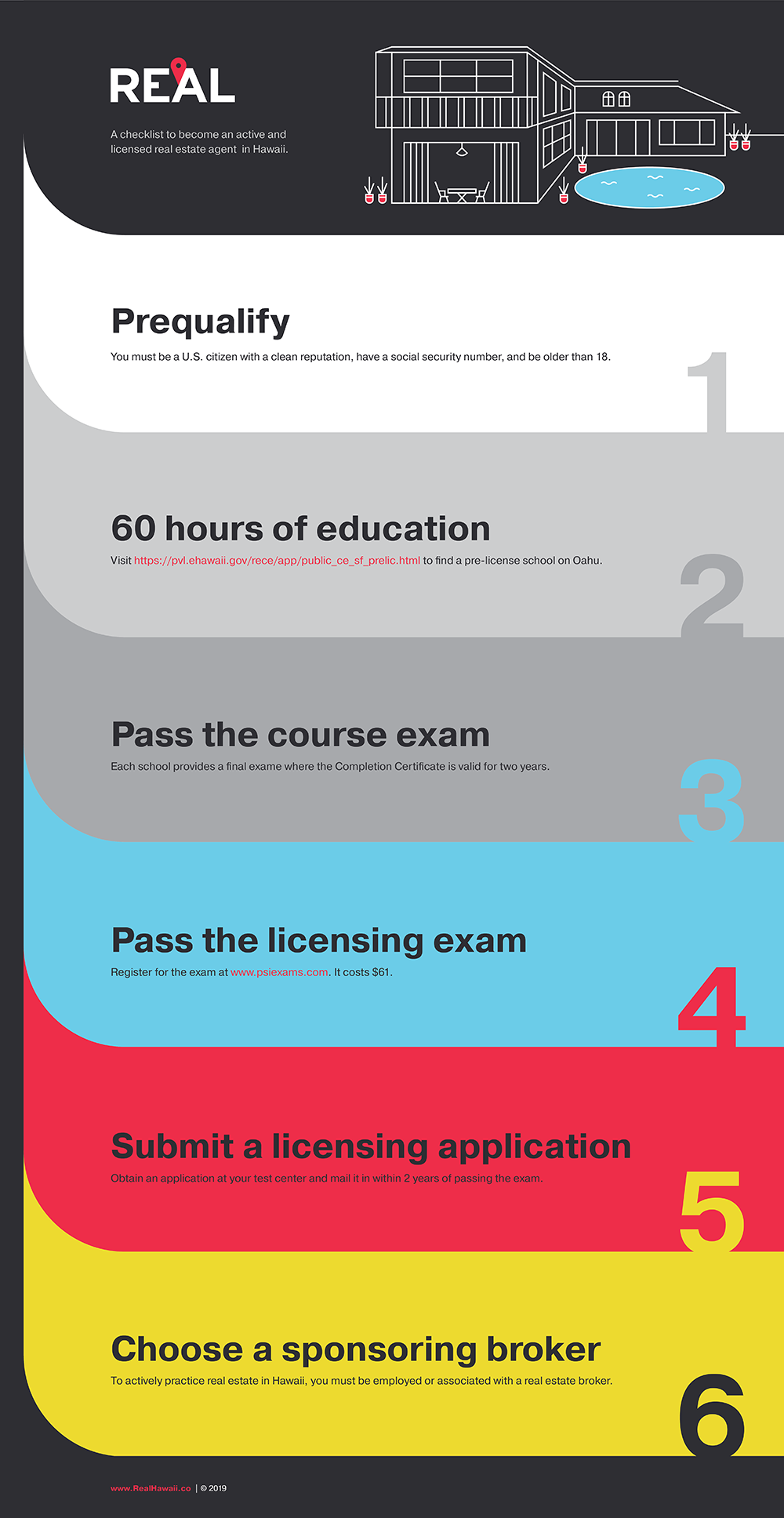

How to become an agent in real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires studying for at minimum 2 hours per night over a 3 month period.

After passing the exam, you can take the final one. You must score at least 80% in order to qualify as a real estate agent.

Once you have passed these tests, you are qualified to become a real estate agent.