How do I get a Nevada license as a realtor? Here are the details: Costs, requirements, and how to pass the exam. You can begin your real estate career by becoming a licensed broker or salesperson in Nevada. Many doors can be opened by obtaining a Nevada real-estate license. You can become a licensed realty agent by signing up today! Continue reading to learn more. This guide should make you more confident about taking the exam.

How to get a Nevada real estate license

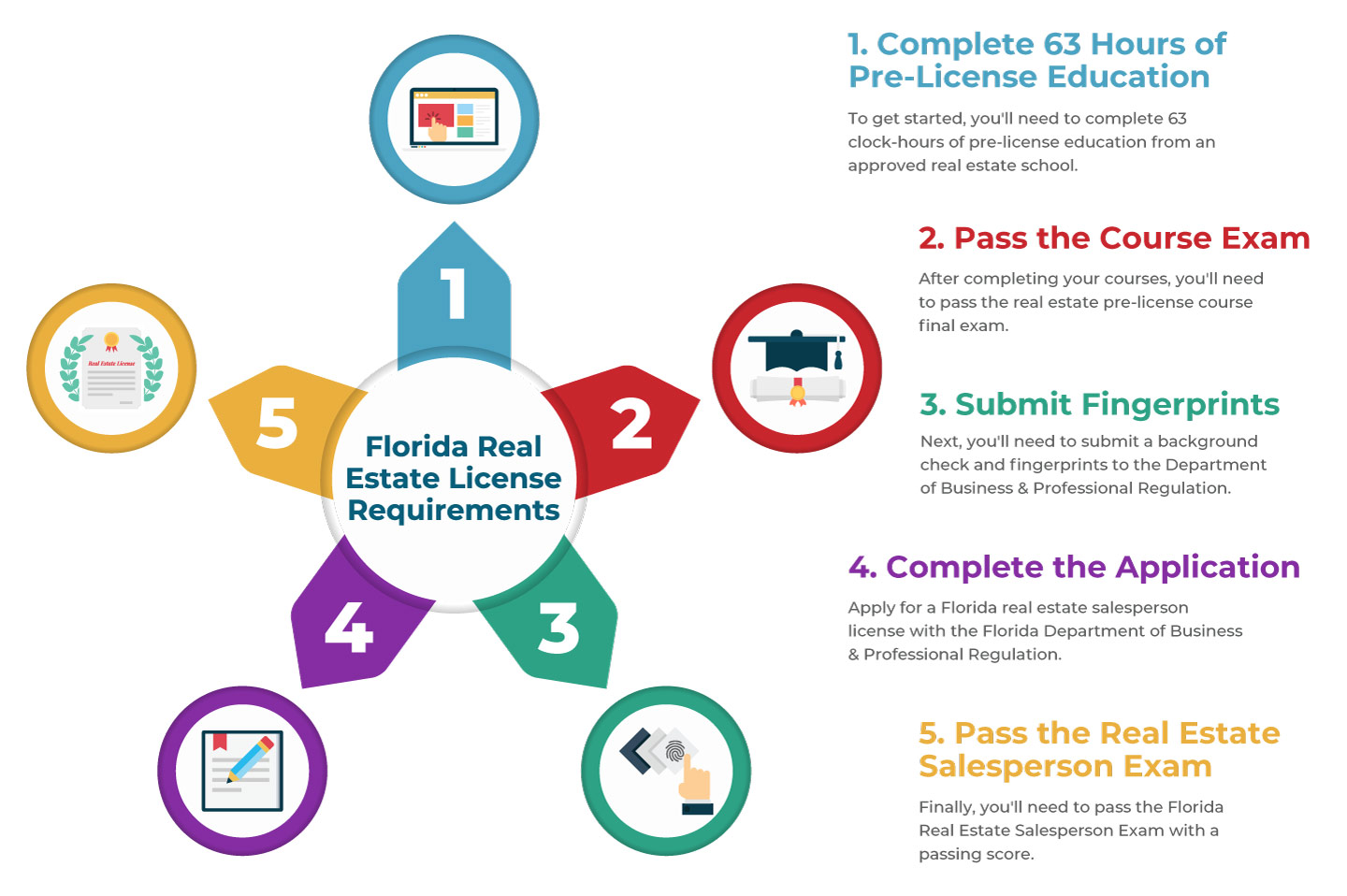

You must complete the required education course before you can get a Nevada real-estate license. This course will prepare you to take the real estate salesperson examination. The course must be completed within a year of your license being granted. A free online education program can help you determine if you have successfully completed the course. You can then take the real estate broker exam. This exam is challenging but can be passed if you study.

For you to get your Nevada real-estate license, you will need to work as an employee broker for a specified amount of time. This will give you practical experience and will help you pass the real-world licensing exam. The broker will also pay for your daily expenses, such as insurance and Internet service. Your application for the license must be signed by your employer. There are many online courses that will help you understand what to expect once you receive your Nevada real-estate license.

Nevada Real Estate License Costs

In order to become licensed in Nevada as a realty agent, you will need to complete an application for a license. The application fee is $125. This process can take between two and three weeks, sometimes even several months. The background check is required and fingerprints must be taken. Most schools offer fingerprinting services. The background check costs $60 to $90. After passing the background checks, you need to complete 24 hour post-licensing educational.

Submitting fingerprint cards is the first step in obtaining a Nevada real property license. This requires a cashier’s cheque or money order. Payable to the Department of Public Safety. Any Fingerprint Vendor in Nevada can verify the fingerprint card. To avoid any delays, you should submit your application as early as possible. It is a good idea to submit all documents by the application deadline.

Exam requirements to obtain a real-estate license

The state mandated test for real estate agents in Nevada is required. The test consists of two sections: one for the national part and one for the state. The national section has eighty questions, while the state section contains forty questions. The exam takes approximately 90 minutes. Two forms of signature ID and a $100 exam fee will be required. You will need to score at least 60 points on the national and state sections in order to pass the exam.

Nevada has similar requirements for those new to the realty industry. The requirements to become a Nevada real estate agent include passing an exam, a background check, and being 18 years of age. Additionally, they must be a US citizen or a lawful alien. The applicants must also be fingerprinted. The fingerprint scanning center can provide more information about the state's fingerprinting requirements.

FAQ

Should I use a broker to help me with my mortgage?

A mortgage broker may be able to help you get a lower rate. A broker works with multiple lenders to negotiate your behalf. However, some brokers take a commission from the lenders. You should check out all the fees associated with a particular broker before signing up.

Is it possible to sell a house fast?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. But there are some important things you need to know before selling your house. First, you must find a buyer and make a contract. You must prepare your home for sale. Third, you need to advertise your property. Finally, you need to accept offers made to you.

How much money do I need to save before buying a home?

It all depends on how long your plan to stay there. If you want to stay for at least five years, you must start saving now. But if you are planning to move after just two years, then you don't have to worry too much about it.

What is reverse mortgage?

A reverse mortgage lets you borrow money directly from your home. It allows you to borrow money from your home while still living in it. There are two types: government-insured and conventional. If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. FHA insurance covers your repayments.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to find an apartment?

Finding an apartment is the first step when moving into a new city. This process requires research and planning. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. There are many ways to do this, but some are easier than others. Before you rent an apartment, consider these steps.

-

Online and offline data are both required for researching neighborhoods. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

See reviews about the place you are interested in moving to. Yelp. TripAdvisor. Amazon.com all have detailed reviews on houses and apartments. You can also check out the local library and read articles in local newspapers.

-

Call the local residents to find out more about the area. Talk to those who have lived there. Ask them what they loved and disliked about the area. Ask if they have any suggestions for great places to live.

-

You should consider the rent costs in the area you are interested. You might consider renting somewhere more affordable if you anticipate spending most of your money on food. Consider moving to a higher-end location if you expect to spend a lot money on entertainment.

-

Learn more about the apartment community you are interested in. What size is it? What's the price? Is it pet-friendly? What amenities does it have? Is it possible to park close by? Do tenants have to follow any rules?